Avenue Digital Investment FoF is a regulated

long-biased fund for professional investors

created in 2019.

Today’s social-economic coordination is built on so many complex layers of trust that it’s often inefficient, and abuse is difficult to detect.

Blockchain technologies enable value and property rights on the internet. It is a major upgrade of the internet of information.

The properties of Web3 will penetrate the real world, enabling scaling and coordination solutions that will offer significant decentralization and dis-intermediation efficiencies (trust efficiencies) through improvement in productivity, innovation, and distribution of value.

We believe tokens are the greatest capital formation mechanism there is and will become core in companies’ capital stack, creator economies and social communities.

Our conviction is that Web3 technologies are a major part of the exponential age, and crypto assets offer the best investment opportunity over the coming decade.

Avenue Digital Investment FoF (Formerly known as Avenue Crypto IC SICAV p.l.c.) offers a fully regulated alternative investment fund to provide professional investors with exposure to digital assets.

Avenue Digital Investment FoF combines solid traditional and crypto expertise in its fund management.

Avenue Digital Investment FoF is an alternative investment vehicle registered as a SICAV in Malta, with a sub-fund in Cayman Islands, and is supervised by the Malta Financial Services Authority.

4 investment Themes

3 TIER hierarchy

_Network Infrastructure

_DeFI

_NFTS/Metaverse

_Cryptocurrencies

The investment approach is agnostic, driven by value capture and a strong conviction in long-term view.

_Core

_Thematic

_Opportunistic

Investment opportunities are monitored, their business models analysed and networks decomposed and valued using on-chain data, proprietary models and other tools.

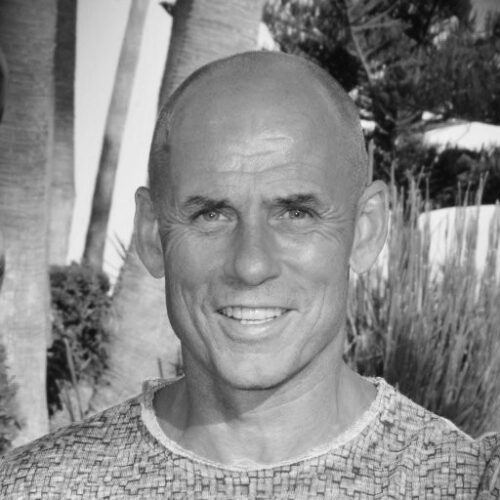

Arne has 14 years of experience in investment banking (analyst, equity sales and management) and 22+ years of experience in asset management.

He left his role as Managing Director at Alfred Berg Norge in 1999 to co-found the hedge fund Futuris Asset Management – (part of Brummer & Partners), where he was CIO until December 2014 (486% returns).

Since January 2015 until now, he has served as the CIO of Avenue Investment and Avenue Digital Investment FoF. He began to actively participate in the field of cryptocurrencies in 2017 and launched the Avenue Digital Investment FoF (previously, Avenue Crypto) in May 2019.

Francisco has >10 years experience in decentralised technologies, as well as having held a number of leadership positions at Rothschild Spain, ABN AMRO – Rothschild and Credit Suisse First Boston EMEA-FIG.

He left CSFB in the year 2000 to work in the technology sector, after which he has worked, collaborated, and advised a large number of companies in the TMT sector, among them Telefónica Media and Dentsu.

He’s been involved full time in the cryptocurrency field and the study of decentralised systems since 2012. He joined Avenue Digital Investment FoF in mid 2020 to take on the role of co-CIO and Head of Research.

- Fund Type

_Alternative Investment Fund - Pricing

_Monthly - Investment Manager

_FMG (Malta) Ltd - Fund Manager

_Arne Vaagen, CIO - Fund Manager

_Francisco Gordillo, co-CIO & Head of Research

- Subscription Notice

_6 business days preceding the Subscription Day (Subscription Day) - Redemption Notice

_60 days preceding the Redemption Day (Redemption Day) - Minimum Investment

_EUR 100,000

- Management Fee

_1% - Performance Fee

_20% on profits over HWM - Currency Class

_EUR (€) - Bloomberg Ticker

_AKJACIA MV

- ISIN

_MT7000025300 - Administrator

_Apex Fund Services (Malta) Ltd - Auditor

_PwC - Inception Date

_22nd May 2019

We have worked and collaborated with some of the biggest brands.